As the year draws to a close, wealth managers and financial advisors across Canada and the USA face...

In today’s digital landscape, financial advisors face growing challenges in managing and securing vast amounts of sensitive data. The questions that professionals handling sensitive information need to ask are what information do we need to store, where or how should we store it and how should we manage who accesses it? This is further complicated by the need to keep information consistent between different systems to eliminate errors, reduce manual work and improve client service.

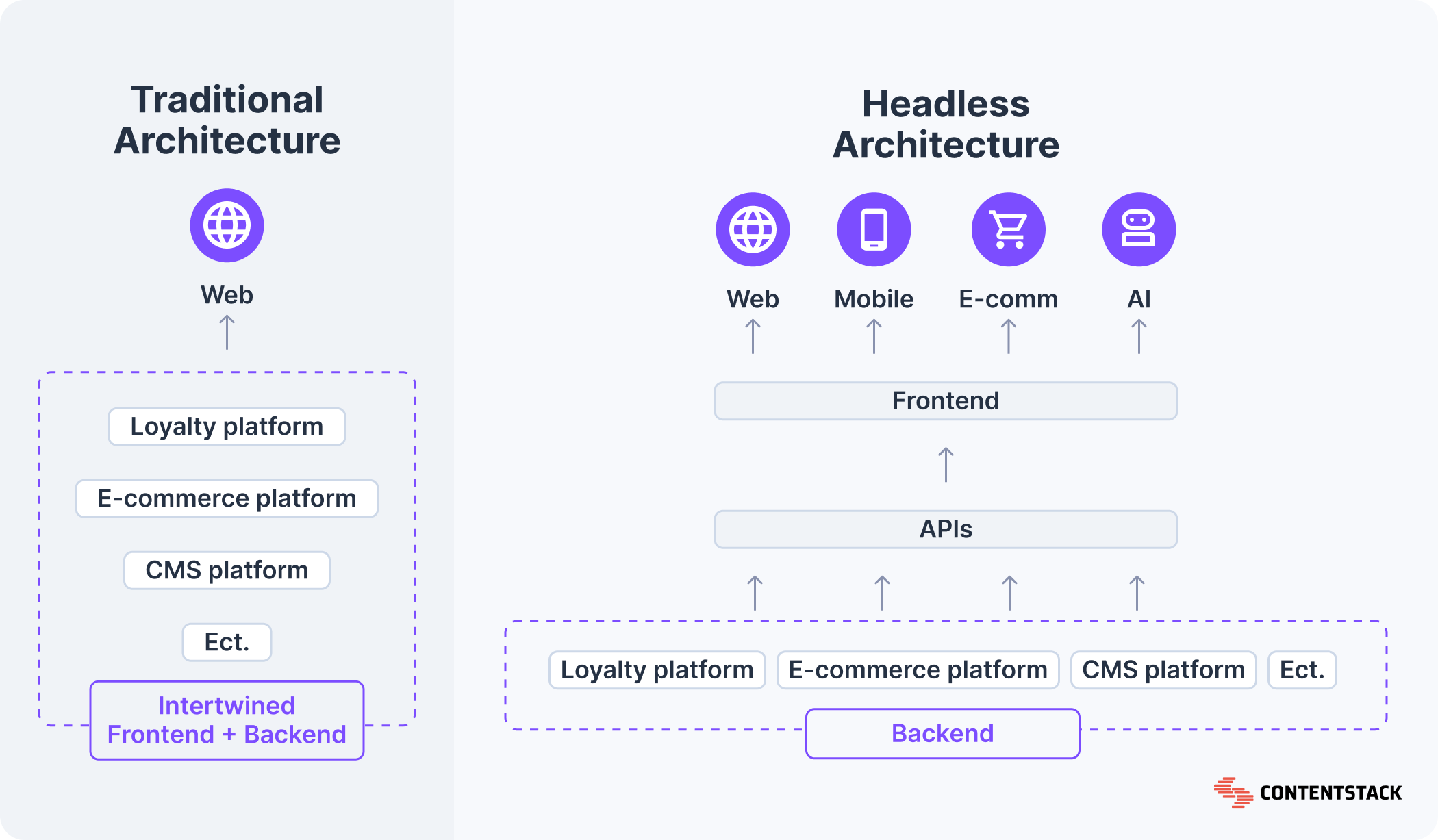

When thinking about keeping data in sync between the systems used to provide a financial service, a critical decision is choosing between two different synchronization approaches: accessing data headlessly—via real-time streaming from centralized servers—or traditionally, by storing local copies in each system (mirroring). Understanding these methods and their impact on data security and accessibility is essential .

Understanding Streaming and Mirroring

Streaming

Streaming involves accessing data directly from its primary storage location in real time. Instead of storing multiple copies, files are delivered “on-demand” as users or applications require them. This approach can offer several advantages:

-

Efficiency: Minimal local storage is required, reducing overhead and latency.

-

Up-to-date Access: Users always interact with the latest version of data.

-

Security Considerations: Streaming demands secure, continuous connections and encryption protocols to protect data in transit, making it critical for industries with high security requirements, such as financial services.

For example, an ECM system utilizing streaming allows financial advisors to retrieve client documents or market data in real time, ensuring that sensitive information is securely transmitted over encrypted channels.

Mirroring

Mirroring, on the other hand, involves creating exact copies of files across multiple storage locations. This replication enhances data redundancy and accessibility by ensuring that even if one server or location encounters an issue, another holds an up-to-date copy of the data. Key aspects include:

-

Redundancy: Multiple copies safeguard against data loss from hardware failures or cyberattacks.

-

Accessibility: Data becomes available from various locations, which is beneficial in high-availability environments.

-

Security Considerations: While mirroring increases the number of data copies, each copy must be equally secured to prevent unauthorized access. Robust secure document management systems and consistent encryption policies are essential to mitigate risks.

For financial advisors, mirroring ensures uninterrupted access to critical documents and supports compliance by providing system resilience.

Defining The Differences: Headless vs. Traditional

-

Traditional (Mirroring): Data is replicated and stored locally as exact copies. This method enhances redundancy and provides quick offline access, similar to solutions like Google Drive for desktop.

-

Headless (Streaming): Data is accessed on demand directly from its primary storage location. This method eliminates the need for local storage copies, ensuring users always interact with the most current version of the file.

Choosing the Right Strategy

For financial advisors, the decision between streaming and mirroring—or a hybrid approach—depends on several factors:

-

Data Criticality: Highly sensitive data might benefit more from secure streaming to ensure the most current version is accessed, while transactional or backup data might be better suited for mirroring.

-

Data Privacy and Sensitivity: Not all data is created equal and the nature of it warrants different treatment. Classifying 'sensitive' and 'confidential' information and storing them in a system that restricts access can add a valuable safeguard.

-

Regulatory Compliance: Both strategies must align with industry regulations. A system integrated with secure workflows can automatically enforce compliance measures across all storage methods.

-

Infrastructure: Organizations with robust cloud hosting capabilities can leverage both methods to optimize performance, security, and accessibility.

By carefully assessing these factors, financial institutions can tailor their data management strategies to not only meet regulatory requirements but also enhance the overall efficiency and security of their operations.

How SideDrawer Enhances Data Management

SideDrawer is a secure digital vault and collaboration platform specifically designed for financial professionals. It offers the data governance, integration and workflow capabilities of a Secure Document Management System and an Enterprise Content Management System while being tailored to content and files handled by financial service professionals. Its Desktop Application and Cloud Integrations extend the platform by intelligently managing file storage through both mirroring and streaming.

Local Mirroring for SideDrawer-Managed Files

-

Secure Vault Integration: Files stored directly in SideDrawer can be automatically mirrored to a dedicated local directory.

-

Offline Access: Financial advisors can access essential documents even without an internet connection, ensuring continuity in client services and decision-making.

-

Efficient Use of Local Storage: By mirroring only SideDrawer-managed files, the application minimizes unnecessary local data duplication.

Streaming for Externally Sourced Files

-

Selective Sync: Files from external cloud services (e.g., Dropbox or Google Drive) that are integrated with SideDrawer remain streamed. They are accessed on demand rather than stored locally.

-

Optimized Storage & Security: This approach prevents redundant copies, preserving local disk space and reducing potential security vulnerabilities associated with multiple data copies.

Workflow Integration and Process Design

SideDrawer’s processes are carefully engineered to enhance both security and user experience:

-

Centralized Management & Automated Workflows:

SideDrawer consolidates sensitive documents into one secure environment. Automated workflows—ranging from document collection and review to approval processes—reduce manual errors and ensure regulatory compliance. These automated processes are critical for financial advisors who must navigate complex regulatory landscapes. -

User Interface & Local Integration:

The Desktop Application integrates seamlessly with the operating system’s file explorer. The familiar file explorer interface makes it easy for both novice and advanced users to navigate and manage files. Visual cues such as clear icons and labels streamline the user experience. -

API-First Architecture and Third-Party Integrations:

With pre-built integrations with platforms like Salesforce, DocuSign, and Zapier, SideDrawer embeds securely within existing business systems. This not only automates data synchronization but also facilitates secure document exchange and workflow embedding allows clients to select if, what and how information gets shared between systems. -

Selective Storage Strategy:

By mirroring only the files stored directly within SideDrawer and streaming external cloud files, the platform minimizes risks associated with local data exposure. This selective sync ensures that sensitive data remains within a controlled environment while still leveraging the benefits of cloud hosting for extended functionalities.

Why This Design Matters for Financial Advisors

Financial advisors operate in an environment where both data security and accessibility are non-negotiable. The dual approach of streaming and mirroring in SideDrawer offers distinct advantages:

-

Enhanced Security:

Sensitive client documents remain secure through encryption, role-based access, and controlled local mirroring. By avoiding redundant local copies of externally hosted files, the platform reduces the risk of data breaches. -

Improved Workflow Efficiency:

Automated processes integrated within SideDrawer’s ECM system ensure that document workflows are streamlined. Financial advisors can focus on client interactions rather than managing disparate storage systems. -

Regulatory Compliance:

Centralized content management and integrated workflows help meet stringent regulatory requirements. Secure, auditable processes simplify compliance with financial regulations. -

User Flexibility:

Whether accessing documents via a local directory or through streamed content, financial advisors benefit from fast, reliable, and secure data access—crucial for making timely decisions in a fast-paced industry.

Conclusion

In the evolving landscape of digital data management, understanding the difference between streaming and mirroring is vital. Financial advisors need to balance the benefits of real-time data access with the security and redundancy offered by data replication. With SideDrawer, organizations can implement hybrid solutions that offer both enhanced accessibility and robust security—ensuring that critical financial data is always available and protected.

.png)